Recent Client Stories

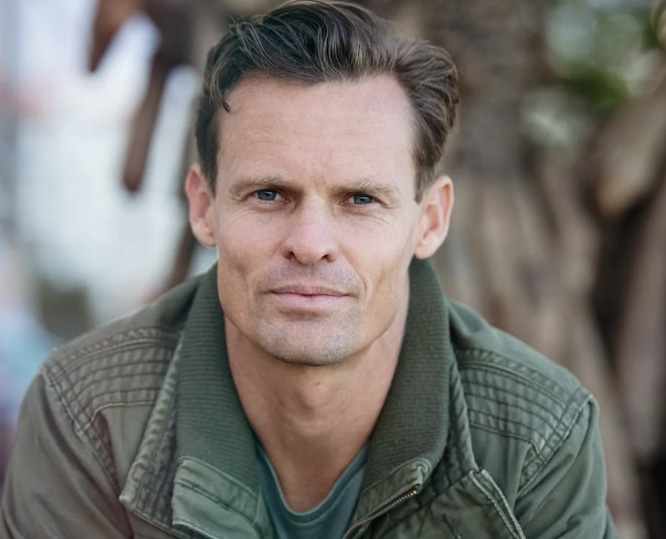

Meet Chris

Five years after Chris started his mortgage protection plan, he was diagnosed with stage 3 prostate cancer. Unable to work for several months, Chris took advantage of his critical illness benefit to pay medical bills, the mortgage and other expenses. Without the money from this benefit, Chris wouldn’t have been able to cover many of those expenses.

Meet Kaiks

Kaiks purchased a plan designed to build tax-free income. The longer he deferred receiving monthly income, the more the account value grew. Kaiks invested $1,200/month into the plan, averaging a 7.2% return over fifteen years.

In year fifteen, Kaiks borrowed $150,000, tax-free, out of the policy’s cash value for a real estate investment opportunity. Kaiks grew the $150,000 he borrowed to $250,000. When the real estate transaction was completed, he returned borrowed back into the policy. Interestingly, the policy continued earning interest as if the $150,000 was never borrowed. What’s more, Kaiks didn’t have to repay the loan for over five months.

Meet Adelle

At 61, Adelle, a widow, invested her late husband’s $175,000 death benefit into one of our Lifetime Income programs. When she retired at 70, Adelle activated the Guaranteed Lifetime Income benefit. She now receives $1,750/month. At 90, Adelle will have received $420,000 in monthly payments. The lifetime income is predictable and guaranteed until the day she dies.

Meet Patricia

Patricia had two goals: first, to provide a guaranteed tax-free benefit to her children when she passed away, and second to protect her family’s finances if she suffered a heart attack, cancer stroke or other qualifying condition during her working years.

Six years after purchasing the policy, Patricia was diagnosed with stage 4 cancer. Her policy permitted her to access her $250,000 death benefit because she suffered a qualifying condition. She chose to take 90% of her death benefit. Patricia had paid $6,264 in premiums and received a check for $210,445. When she passed away, her beneficiary received an additional $25,000.

Meet Rey

At 45 Rey, like most, hadn’t saved enough for retirement and wanted to catch up. We showed Rey how to use leverage to accumulate wealth. Rey had contributed $35,000 annually into our program for five years; our partners matched Rey’s contribution. (In years 6-10, our partners cover both contributions.) Rey is expected to receive $72,350 annually from age 65-90. In most cases, this income is 100% tax free. If Rey lives to 90, he is expected to have received $1,881,095 in tax-free income. That wealth was created from contributing $35,000 annually for only five years starting at age 45.

Meet David

David and his wife, both semi-retired, were concerned about the potential cost for long-term care. They also wanted to leave an inheritance to their children while enjoying their golden years. We transferred $400,000 into a Protected Growth Program that offers Enhanced Benefits for both spouses if they become chronically ill. Over the last six years, that $400,000 has grown to $563,000, with zero risk to the initial investment.

Meet Jim

Jim thought he had saved enough to last through his retirement, but realized he was in over his head. He needed money to cover living expenses and monthly premiums, which had become more than he could afford. He considered letting his life insurance policy lapse, until his financial advisor recommended evaluating all of his policy options first. He learned about our Life Settlement option, which makes cash available quickly. We helped Jim pay his premiums and update his policy. Jim’s life insurance policy was saved, and he collected $110,000 to cover his expenses. Thanks to the Life Settlement option, Jim now lives free of financial stress. “I am grateful for the service provided to me throughout the entire process,” he says. “It was quick and painless, and it eased my financial worry.”

Meet Sonia

At 61 Sonia took $275,000 she had in CDs and invested in one of our Protected Growth Programs. She planned to retire at 64, but she wanted to defer her Social Security until age 70. We had the perfect six-year bridge: Sonia will withdraw $22,785 annually once retired, allowing her to defer her Social Security benefit. By 70 she will have withdrawn $136,710, and her account value is expected to be around $280,000. What’s more, Sonia’s Protected Growth Program allows her to receive 32% more income annually in Social Security because it gave her the ability to defer her benefit.